Quantum Health Benefits

No Net Cost

EMPLOYER/EMPLOYEE BENEFITS Program

Financial Benefits Coupled with WORKPLACE HEALTH & WELLNESS

A Fully-Insured Healthcare Management Program with Financial Benefits for Both Employer and Employee

ZERO NET COST FINANCIAL BENEFITS TO BOTH EMPLOYER & EMPLOYEE COUPLED WITH A WORKPLACE HEALTH & WELLNESS PROGRAM

NO NET COST HEALTHCARE BENEFIT PLANS

Fully Compliant

Preventive and Wellness

Management Programs with Profit Incentives

What are No Net Cost Health & Wellness Plans?

- Now available in the market, allows both Employer and Employee to profit while also delivering a well sought out Health & Wellness Plan that is in addition to any existing plan already in place by an employer

- At its core, the Quantum plan is a fully insured IRS Section 125 Indemnity Plan (“Cafeteria” plan) that has been in existence since 1978

- The result is that every Employer pays lower FICA taxes – averaging $800+ savings per qualifying and participating employee

- In addition, Employees receive an increase in take-home pay and a variety of healthcare and wellness benefits

- The Quantum program has been – (1) designed and made commercially available by major insurance companies, and (2) approved by all 50 states and US possessions, and (3) accepted for marketing by major insurance brokerage firms.

- With NO net cost to the employer or employee, now or ever!

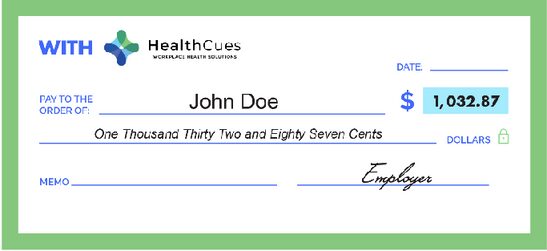

Employer Savings of $957.00 Annually Per Employee for Plan VI ($1,500)

Explanation of Employer Net Savings

| Total FICA savings per employee monthly ($1,500) | $1,500.00 | 7.65% | $114.75 |

| Annual Employer FICA savings total | $114.75 | 12 | $1,377.00 |

| Quantum Employer monthly fee per Employee | S35.00 | 12 | $420.00 |

| Net Employer Savings | $1,377.00 | $420.00 | $957.00 |

Employer Savings of $681.60 Annually Per Employee for Plan V ($1,200)

Explanation of Employer Net Savings

| Total FICA Savings Per Employee Monthly ($1,200) | $1,200.00 | 7.65% | $91.80 |

| Annual Employer FICA savings total | $91.80 | 12 | $1,101.60 |

| Quantum Employer monthly fee per Employee | S35.00 | 12 | $420.00 |

| Net Employer Savings | $1,106.00 | $420.00 | $681.60 |

Annual Net Employer Savings For All 6 Plans

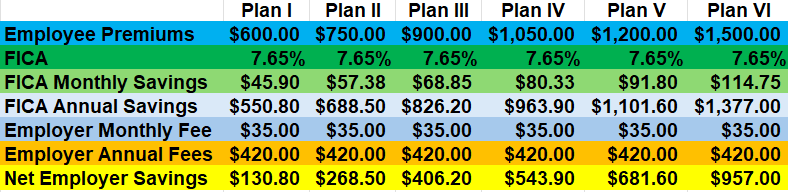

Employee Sample Payroll Analysis

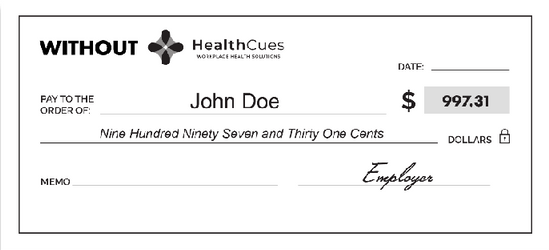

Monthly Paycheck

Example - $50,000 Salary

Premium Payment

- Hospital Indemnity Plan

- Prescription Drug Plan

- Telemedicine Benefit

- Emergency Room Benefit

- Critical Illness Benefit

- Accident Plan

- Surgery & Anesthesia Benefit

- Ambulance Benefit

Quantum and History of Section 125 Health Plan

Section 125 plans introduced to allow for health benefits on a Pretax basis.

Affordable Care Act launched to improve access to health coverage for individuals nationally.

Wellness benefits added to the ACA allowing for the payment of specific wellness program activities.

Section 125 Indemnity benefit plans become fully insured products by major insurance carriers.

QHB Launches its fully insured plan and receives State approvals nationally.

Quantum Health Benefits is an Exclusive Partner with Several A.M. Best “A” Rated Carriers and Offers Its Fully Insured Plan Nationally and In all us Possessions.

Plan Benefits

Providing a Healthcare Management Platform that gives you the power to take control of care!

Daily Hospital Confinement Benefit

Benefit payable per day of confinement: $1000

Max number of days payable: Up to 30 days

Daily Emergency Room Visits - Sickness & Injury

Benefit payable per day: Up to $500

Max number of days payable: 1 day

Daily Inpatient Surgery - Anesthesia

Benefit payable per day: $400

Max number of days payable: 1 day

Critical Illness Benefit

Lump Sum First Diagnosis: $2,500

Invasive cancer, heart attack and stroke

Daily Ambulance Benefit

Benefit payable per day: Up to $500

Max number of days payable: 1 - 2 days

Daily Inpatient Surgery

Benefit payable per day: $1,000

Max number of days payable: 1 day

Supplemental Benefits

RX Plan

- $0 Copay Acute Formulary

- $0 Copay Chronic Formulary

- $0 ACA MEC Formulary

Telemedicine

- Includes Behavioral Health

- 24/7 Access and $0 Copay

- Includes Family Members

Wellness Plan

- Nutrition Education

- Online Learning Modules

- Stress & Sleep Programs

- Smoking Cessation

Accident Plan

- $1,000 Benefit

- Inpatient

- Outpatient

Telemedicine

Virtual urgent care and behavioral health

Activate your account to connect with board-certified physicians, psychologists and psychiatrists anytime, anywhere in the United States.

- Easily request medical consultations to receive ailment diagnosis and treatment plans for you and your dependents.

- Schedule doctor consultations when it’s most convenient for you.

- Select your preferred pharmacy for easy prescription pick-up.

- Avoid waiting in urgent care centers and emergency rooms.

We treat common and behavioral medical conditions including:

- Eye Infection

- Fever

- Headache

- Insect Bites

- Nausea/Vomiting

- Pink Eye

- Substance Abuse

- Depression

- Stress and Anxiety

- Bipolar Disorder

- Addiction

- Trauma and PTSD

- Abrasions

- Allergies

- Cold/Flu

- Constipation

- Cough

- Diarrhea

Easy Mobile App

With our mobile app, you can easily check up on your health and access the full suite of benefits.

How The Quantum Plan Works

A premium is deducted from the employee’s paycheck through a Section 125 Cafeteria Plan.

| This deduction is the Insurance premium for a Fully Insured Indemnity Insurance Plan |

|---|

| Hospital Indemnity Plan | Hospital Emergency Room | Ambulance Ground & Air | Proactive Wellcare | Accident & Critical Illness | Telemedicine | RX plan | Surgery & Anesthesia |

How The Quantum Plan Works

A premium is deducted from the employee’s paycheck through a Section 125 Cafeteria Plan.

| This deduction is the Insurance premium for a Fully Insured Indemnity Insurance Plan |

|---|

| Hospital Indemnity Plan | Hospital Emergency Room | Ambulance Ground & Air | Proactive Wellcare | Accident & Critical Illness | Telemedicine | RX plan | Surgery & Anesthesia |

This deduction lowers the employee’s taxable income creating a tax savings for both employee and employer.

The Employee benefits from a healthy lifestyle changes through access to the Quantum Proactive WellCare Plan Benefit.

Their participation generates a Section 125 Cafeteria Plan claim paid directly from the insurance company into their paycheck.

Quantum Benefits Based On Plan Each Employee Qualifies For

*Benefits may vary based on carrier and State

Services eligible for Health

Screening Benefits Rider:

- Telemedicine

- Consult with Medical Professional

- Video Interactions

- DNA Screening

- Biometric Screening

- Online Health & Wellness

- Program Coaching

- Telephonic Health & Wellness

- Program Coaching

- Health Risk Assessments

- Genetic Risk Assessment

How We Help Employers

Today's technology and healthcare innovations make it possible for you, the employer, to offer a program that will make employees healthier, happier and more productive without increasing and possibly decreasing future medical costs.

Profitability

There are several ways Quantum Health Benefits improves a company’s profitability. First, the Quantum Health Benefits Plan is paid for with pre-tax dollars which saves the employer an average of $600-$900/year per participant. Secondly, happy and healthy employees mean improved productivity and decreased absenteeism.

Financial

Most major medical plans have substantial out-of-pocket expenses from deductibles, copays, coinsurance and prescription drug costs. We provide each employee a suite of benefits designed to address these issues and lessen the financial burden on both the employer and employee.

Wellness

The Quantum Health Benefits Plan improves overall health and wellness through a few simple monthly activities. These activities include self-directed courses, health quizzes, HealthWallet health risk assessment, health scores and risk identification.

The QHB Advantage…

We Do It All!

-

Implementation

We work directly with your Human Resource and Payroll departments to ensure a seamless implementation of the Quantum Health Benefits Plan.

-

Enrollment

Our enrollment team will educate the employees on their new benefits, how and where to access them and how the Quantum Health Benefits Plan will result in a net increase in take-home pay for most employees.

-

Administration

Our staff handles adding new employees, billing issues/questions and claims inquiries from employees.

-

Payroll Reporting

Our payroll software interfaces with all the major payroll programs. In addition, we generate a payroll report every pay period.

Next Steps

Run A Payroll Census

This will illustrate the company savings, increases in employee take-home pay and employee benefits.

Execute the RFC and MSA

Once these documents are signed, we can start the implementation process.

Implementation process

We meet with your Human Resource and Payroll departments to coordinate the execution and administration of the Quantum Health Benefits Plan.

Enrollment

Our enrollment representatives are available to discuss with each employee the benefits of the Quantum Health Benefits Plan, how to enroll in the Proactive WellCare App, how to file an insurance claim, and answer any questions that employees may have.

-

We create a profit for the employer, while allowing each employee to see an increase in their take home pay.

-

As your partners in health and wellness, we will provide exceptional care for your employees.

-

The result is a healthier, happier workforce with Quantum Health Benefits.

PTE Group, Inc.

Quantum is Fully Compliant

A variety of federal laws and regulations are designed to protect employees and

prevent discrimination in the workplace. They include:

- Employee Retirement Income Security Act (ERISA)

- Americans with Disabilities Act (ADA) and applicable guidance from the

Equal Employment Opportunities Commission (EEOC) - Genetic Information Nondiscrimination Act (GINA)

- Health Insurance Portability and Accountability Act (HIPAA)

- Affordable Care Act (ACA)

- Plan Designed Section 125

- Auto Enroll (DOL) Department of Labor

- Wellness: IRS §106(a) – ERISA IRS §213(d) – ADA, IRS §105-11. HIPAA: IRS §125

IRS§105.11 – IRS §104(a)(3) - Medical: IRS §213(d)ACA

- Pre-Tax: IRS §213 (d) IRS §106(a) IRS §125

- Post-Tax: IRS §213 (d) IRS §105 (b)1.105.11(i) 104(a)(3)

- Reimbursement Plans as defined under 1.105.11(i)

Recap – Employer Annual Savings Employer Savings of $957.00 Annually Per Employee for Plan VI ($1,500)

Explanation of Employer Net Savings

| Total FICA savings per employee monthly ($1,500) | $1,500.00 | 7.65% | $114.75 |

| Annual Employer FICA savings total | $114.75 | 12 | $1,377.00 |

| Quantum Employer monthly fee per Employee | S35.00 | 12 | $420.00 |

| Net Employer Savings | $1,377.00 | $420.00 | $957.00 |

Recap - Employee Monthly Increase in Take Home Pay

Monthly Paycheck

Example - $50,000 Salary

Premium Payment

- Hospital Indemnity Plan

- Prescription Drug Plan

- Telemedicine Benefit

- Emergency Room Benefit

- Critical Illness Benefit

- Accident Plan

- Surgery & Anesthesia Benefit

- Ambulance Benefit